Who we are

Telefónica Infra manages a portfolio of shares in infrastructure vehicles together with financial partners

In November 2019, in the midst of a major tech disruption, Telefónica anticipated to the change of era we are living.

To address it, a “new Telefónica” was designed to continue to be at the forefront of the new times and market demand. As part of the five strategic pillars announced, Telefonica Infra was created.

In Telefónica Infra we manage a portfolio of shares in fiber, subsea cable and data centers. We continuously analise opportunities to create value, exploiting options to develop more flexible financial structures partnering with financial investors to accelerate infrastructure deployments and capture consolidation opportunities. We face the growing demand for quality, secure and reliable connectivity, within an efficient capital allocation framework.

Today, Telefonica Infra is in a privileged position to capture the growth opportunities that arise from infrastructure leveraging on:

- Wide experience in the creation and management of vehicles (complex carve-outs, optimal operations management).

- Creation of different corporate models and proven value creation for investors.

- Access to Telefónica’s assets and operating experience of Telefónica.

- Partnership with Telefónica as anchor customer.

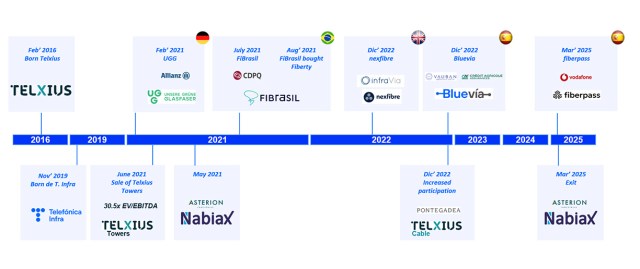

Main milestones

- Monetisation and execution

- Creation of Telxius and value cristalization with the sale of Telxius Towers

- 9 fibre and mobile network sharing models launched with financial partners

- Shareholding in largest data center platform in Spain

Since its creation, Telefónica Infra has focused on:

- Creating strategic optionality for Telxius enabling value crystallization as evidenced by the sale of Telxius Towers to ATC

- Pursuing value creation opportunities in other asset categories, especially in Fibre and Data centers.

Telefónica Infra has a 70% stake in Telxius Cable.

It has also reached an agreement with Asterion to become a joint shareholder in Nabiax, its data center platform, with a 20% stake.

In addition, it has reached agreements with leading financial investors to create wholesale open access operators to deploy and operate fibre in selected areas of Spain (Bluevia with a 55% stake at Telefónica Group level), Brazil (Fibrasil with a 50% Telefónica Group stake), Germany (UGG with a 50% Group stake) and the UK (nexfibre with a 25% stake). Through T-HISPAM, Telefónica Group also has stakes in other fibre companies in Chile (40% stake), Colombia (40% stake) and Peru (36% stake). We currently have a leading portfolio of FibreCos that already covers 22M UUII and offers green connectivity in its footprint.

In terms of mobile networks, we highlight the creation of “Internet para Todos in Peru” (with a 54% stake) and the mobile access network sharing agreement with TIGO in Colombia.

With these infrastructure vehicles fully operational, Telefónica Infra plays an active role in providing more inclusive connectivity, increasingly driving high-quality, next-generation connections.

In the long term, Telefónica Infra has further optionality to explore other asset categories and service models. Telefónica Infra may selectively participate in vehicles to develop certain asset classes in selected countries, together with financial partners. Opportunities will be analysed on an ad-hoc basis, evaluating market opportunity together with Telefónica’s assets and capabilities and investors’ interest to co-invest and partner with us.

Strategy

A strategy based on supporting our operators in the face of the growing demand for quality, secure and reliable connectivity, within a framework of efficient capital allocation.

Telefónica Infra focuses on value creation through 4 key levers:

- Attracting financial investors to co-invest

- Third-party revenues in each vehicle

- Optimising operations and specialised and focused management

- Inorganic opportunities in each market

Thus, Telefónica Infra meets its objectives, which include enhancing the competitive position of Telefónica’s business units (acting as an enabler to accelerate deployments in selected areas of operations and to improve returns through more efficient deployment models), crystallizing the value of the company’s infrastructure assets and capabilities, and capturing future incremental value through equity stakes in infrastructure vehicles.