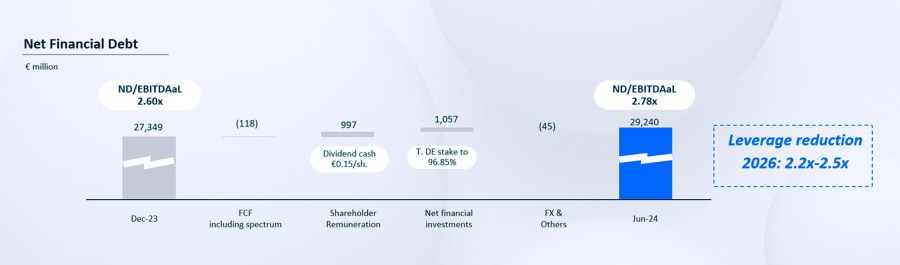

Debt evolution

Net financial debt and commitments

Unaudited figures (Euros in millions)

| December 2023 | June 2024 | |

|---|---|---|

| Non-current financial liabilities | 33,360 | 33,813 |

| Current financial liabilities | 3,701 | 4,467 |

| Gross Financial Debt | 37,061 | 38,280 |

| Cash and cash equivalents | (7,151) | (5,268) |

| Current financial assets | (1,066) | (2,232) |

| Non-current financial assets | (3,421) | (3,861) |

| Mark-to-market derivatives adjustment (1) | 454 | 627 |

| Other current assets and liabilities | (265) | (236) |

| Other non-current assets and liabilities | 1,737 | 1,930 |

| Net Financial Debt | 27,349 | 29,240 |

| Lease Liabilities | 8,920 | 8,196 |

| Net Financial Debt including Lease liabilities | 36,269 | 37,436 |

Notes:

(1) Includes the market value of cash flow hedges related to debt instruments and the market value of economic hedges associated with gross employee benefit commitments.

Financing activity

In H1 24, T. Group raised €3,198m long term financing and VMO2 €2,172m equivalent. Total financing activity: €5,371m.

Financing activities in Q2 24 included:

- In Apr-24, T. Chile signed a CLP 50,000m bilateral loan with maturity in Apr-27.

- Also, in Apr-24, VMO2 issued two senior secured notes of €600m and USD750m, both with maturities in Apr-32.

Telefónica financing activity has allowed the Group to maintain a solid liquidity position of €18,886m (€11,386m of undrawn committed credit lines; €10,681m maturing over 12M). As of Jun-24, the Group has covered debt maturities over the next three years and the average debt life stood at nearly 11.0 years.

Telefónica and its holding companies continued their issuance activity under the Promissory Notes and Commercial Paper Programmes (Domestic and European), maintaining an outstanding notional balance of €1,400m as of Jun-24.

Financial debt

Total Financial Liabilities Breakdown

Unaudited figures (Euros in millions)

| June 2024 | |||

|---|---|---|---|

| Bonds and commercial paper | Debt with financial institutions | Other financial debt (including governments) and net derivatives | |

| Total financial liabilities (1) | 85% | 7% | 7% |

(1) Includes positive value of derivatives and other financial debt

Net financial debt plus Lease Liabilities structure by currency

Unaudited figures (Euros in millions)

| June 2024 | ||||

|---|---|---|---|---|

| EUR | BRL | HISPAM | OTHER | |

| Net financial debt plus Lease Liabilities structure by currency | 73% | 16% | 11% | 0% |

Financial expenses

Interest payments declined 13.8% y-o-y to €646m in H1 24 mainly due to extraordinary payments in Peru (€5m in Q2 24, €10m in H1 24; €119m in H1 23). Excluding this impact, interest payments were stable y-o-y. Debt-related interest payments decreased due to lower interest rates in Brazilian reais debt and a robust fixed interest rates position in strong currencies, which countered the impact of rising interest rates in these currencies. The effective cost of debt related interest payments (L12M) decreased to 3.58% as of Jun-24 (3.80% in Dec-23).

Note: For further information, please access the January – June 2024 Results Report.