A Stronger Company with a Higher Ambition

Telefónica is today a Company with a higher ambition. After the operational transformation process that we started in 2016, we are clearly seeing the benefits this transformation has brought to Telefonica.

And now we are ready to increase our ambition. We have a stronger company: We are back to Growth, with increased Profitability and in a more Sustainable manner.

We enable our GPS framework with a strict and disciplined capital allocation.

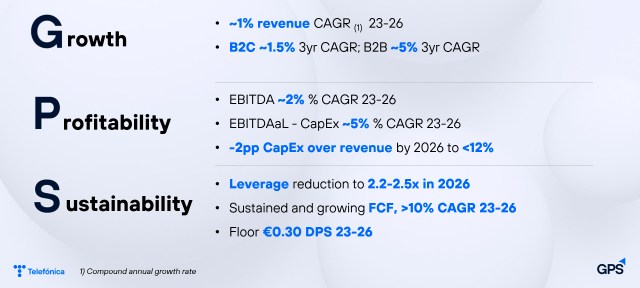

During the next 3 years we aim:

- To grow reported revenue by around 1%, and EBITDA by around 2%.

- This will result into average growth of EBITDAaL-CapEx of around 5%, which as a result of our improved operating leverage will drive FCF growth of more than 10%.

- This will help to create significant shareholder value and allow us to reduce leverage of net debt over EBITDAaL to between 2.2 and 2.5 times, and this includes any payments from our offer to TEF DE minority shareholders. We are committing to an attractive dividend of at least 30 euro cents per share, with improved dividend coverage throughout the plan.

- All this will come from organic sources of capital. Excess FCF from inorganic sources of capital could be used to accelerate the leverage reduction, feed potential share buy backs or could be used for M&A in the period.

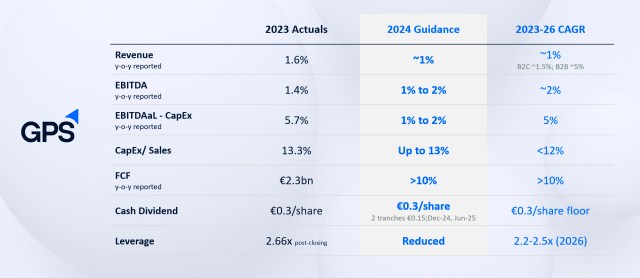

2023-26 guidance

We have confirmed guidance for 2023 and we are also ready to commit for 2024. Our 3-year growth is starting in year one.

- Revenue ~1% growth y-o-y

- EBITDA 1% to 2% growth y-o-y

- EBITDAal-CapEx 1% to 2% growth y-o-y

- CapEx over revenue up to 13%

- FCF >10% growth y-o-y

- Dividend 0.3€/share (0.15€ Dec-24; 0.15€ Jun-25)

We keep commiting

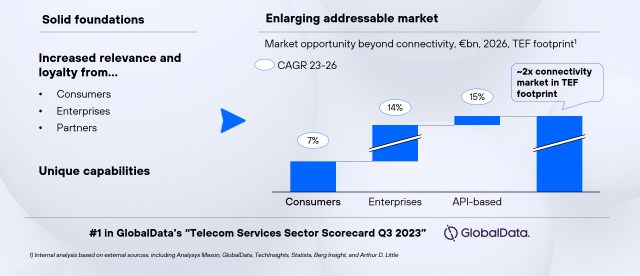

To become more digital intelligent and future proof, with an enlarging addressable market beyond connectivity. We are ready to upgrade the connection with our customers, create a new generation of API-based services, double down efficiencies and capital allocation, and towards a higher sustainability.

During the next three years:

- We will be benefitting from massive legacy switch-off, streamlining our business model.

- We will be realizing the advantages of our proactive investments in platforms and AI, which will manifest as highly automated operations and content management, autonomous network management, and cutting-edge customer engagement strategies.

- We will have rolled out a fully programmable network infrastructure that will reduce operating costs and introduce a new wave of personalized and real-time services to our customers.

All this makes our service faster and more efficient whilst open up new markets for revenue growth. Ensuring more sustainable growth in the long term.

The GPS program is built on 5 lines of action:

- Sustain B2C revenue growth.

On the back of our most valuable telco brands, best network quality and customer experience, with attractive products and bundled services. We are generating the highest customer satisfaction, achieving the highest NPS scores. With our digital B2C ecosystems we are growing customer engagement. We expect to grow B2C revenue by ~1.5% CAGR 2023-26. - Keep above-industry B2B momentum.

We transformed B2B and with the help of T. Tech (our specialist provider of advanced digital B2B solutions in the cloud, cybersecurity, IoT and Big Data fields) have created a fast-growing segment. Our aim is to reach €3bn T. Tech sales by 2026, +18% (CAGR Sep-23 (LTM) – 2026 (EOY)). We have a leading position in growing market. Our evolved revenue base and our combination of traditional B2B together with T. Tech gives us the confidence to expect B2B revenue to grow by ~5% CAGR 2023-26. - Evolve wholesale and others’ revenues.

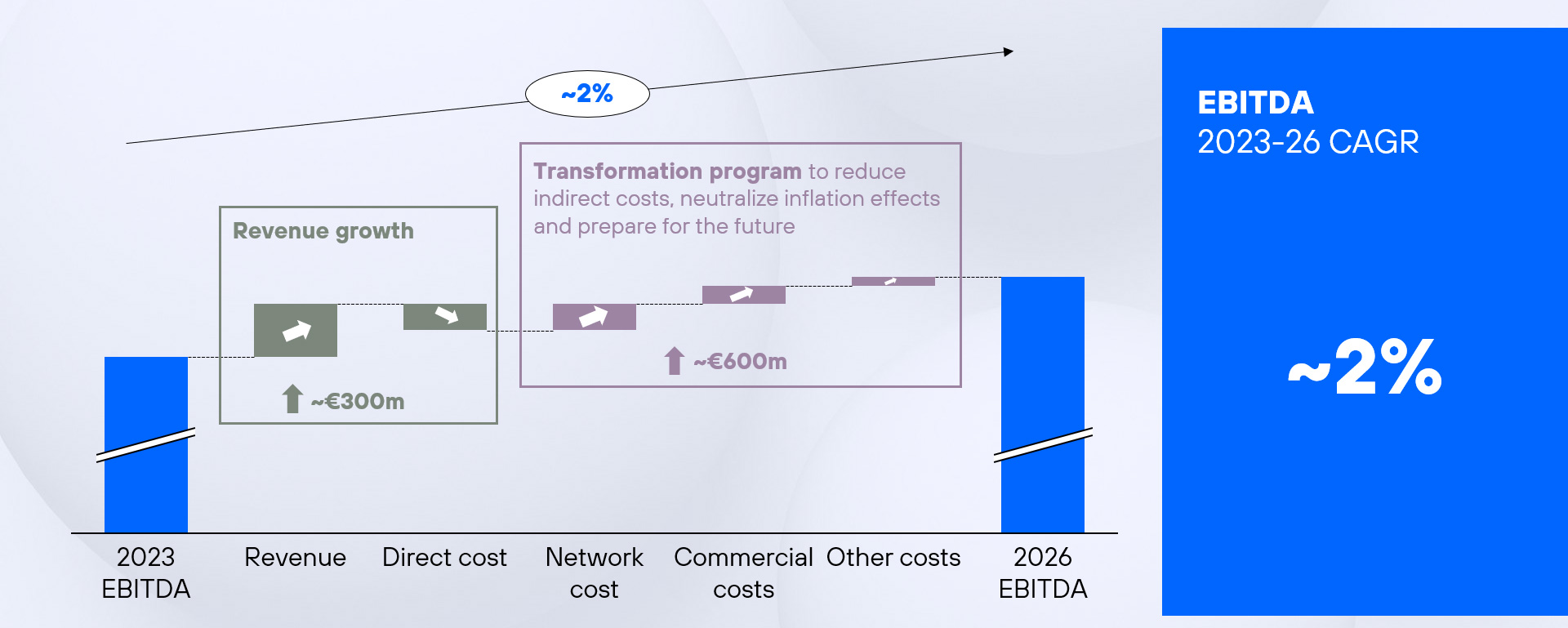

A valuable revenue stream that improves network utilisation, gives access to different customer segments and helps boost returns on the significant investment in our networks. Traditional wholesale has become more competitive, and beyond it, we are adding new services and are entering fast growing markets. We expect a low to-mid-single digit decline in 2023-26 offset gradually by new revenues. - Drive efficiencies to reduce OpEx.

The huge technological transformation is making our business more efficient.- Network efficiencies: shut down (copper in Spain in 2024, 2G and 3G), sharing and optimised rollouts, hyper automation (massive AI initiatives, Zero touch management, Open and cloud-based, API-fication), scale and efficiencies (lease optimisation, freed up spectrum capacity, energy cost reduction, right-sizing the organisation).

- Transformation program to reduce indirect costs, neutralise inflation effects and prepare for the future.

- The combination of revenue growth and efficiency initiatives will drive EBITDA growth. We expect an EBITDA CAGR of ~2% in 2023-26.

TEF 2023-26 EBITDA evolution

- Sustain differentiation while reducing CapEx.

- We started early to invest in Fibre and 5G. Thanks to that our CapEx peak is well behind. We will sustain network differentiation while reducing CapEx.

- T. Infra, the most developed international connectivity network, delivering value.

- Transformation investments made in software, technology and AI.

- We expect CapEx intensity to fall from ~14% 2023 guidance to <12% in 2026.

- In Spain where we will shut down our copper network in 2024, we will reach a benchmark 10% Capex/Sales in 2026.

- Sustain B2C revenue growth.

Core OBs:

- Spain, best positioned, best asset, benchmark low churn and healthy ARPU. Goal to continue growing in consumer revenue and accelerate B2B. Room to reduce costs and opportunities for further efficiencies. CapEx/Sales falling to 10% by 2026. Continued revenue growth and EBITDA growing, starting in 2024. EBITDAaL- CapEx growing faster than revenue and EBITDA.

- Brazil, premium position in a growing market with a complete portfolio of digital services for B2C & B2B. We expect strong growth in all segments, growing our customer base, increasing our share of wallet with expansion in margins, and deploying a fibre network at pace. We expect revenue and EBITDA to continue to grow and EBITDAaL-CapEx to grow faster than EBITDA.

- Germany, growing strongly on network quality improvements and attractive commercial propositions. Goal to maintain B2C growth, accelerate momentum in B2B, and plans in place to mitigate 1&1 wholesale contract loss. Capex/Sales will decline over the next 3 years. We expect revenue, EBITDA and EBITDAaL-CapEx to grow, through the execution of the recovery and growth plan.

- UK, an attractive market with potential consolidation. VMO2 with a loyal customer base, continue to target B2C growth through fixed mobile convergence, digitalisation and AI, with further scope for synergies. We expect to continue delivering strong FCF.

Non-core Hispam: a self-sustained region with reduced capital intensity and risk. Focus on FCF growth by optimising costs and capital intensity. Positioned for full optionality and to reduce exposure further through potential divestments and in-market consolidation. Target to increase EBITDAaL-CapEx by ~5% 2023-26 CAGR and continue reducing invested capital by 15%.

Strict and segmented capital allocation.

Organic cash flow to fund business sustainability. We have lower CapEx intensity, hence more capacity to reduce leverage whilst growing our dividend coverage. Inorganic optionality and other sources to speed up deleveraging, improve shareholder remuneration and look for growth opportunities.

- Organic

- – Capital sources: net operating cash flow from OBs

- – Capital uses: CapEx (<12% CapEx/Sales by 2026), attractive dividend (€0.30 DPS floor), leverage reduction

- Inorganic

- – Capital sources: Excess Cash / Asset recycling / Other sources

- – Capital uses: speed-up leverage reduction, share Buybacks, value accretive M&A

Solid Balance Sheet with leverage target.

- Managing our balance sheet prudently and proactively. Our liquidity, maturities calendar, interest rates and FX strategies.

- Reinforced our balance sheet with a deleverage commitment and target of 2.2-2.5x (ND/EBITDAaL) in 2026.

Clear focus on Growing FCF (>10% CAGR 2023-26).

- Improving dividend coverage and deleverage ability.

- Previous definition: ~€4bn in 2023 and ~€5bn in 2026.

- New definition (excluding spectrum & UK recaps, including hybrids & commitments): ~€2.1bn in 2023, >10% 23-26 CAGR, targeting ~€3bn in 2026.

- With a growing FCF we support our commitment to our shareholders.

- Organic

Capital Markets Day 2023

January-June 2024 results

Telefónica Analysts Consensus

Download our Corporate Profile

Telefónica is building a company for the future.